Net sales are determined as (Sales on Credit) – (Sales Returns) – (Sales Allowances). You can use your balance sheet to find your net credit sales.

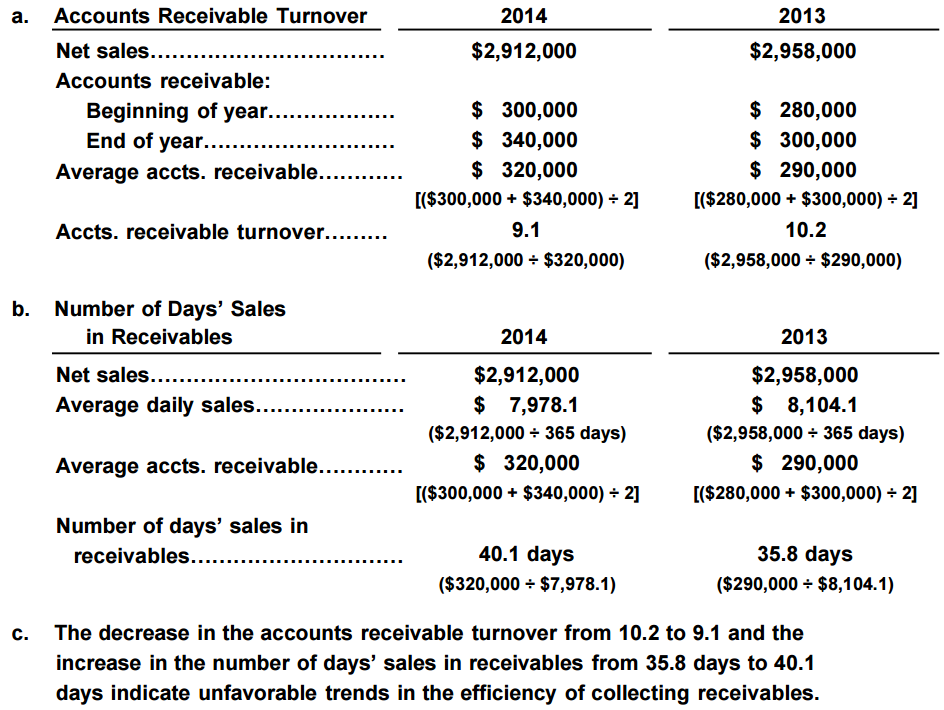

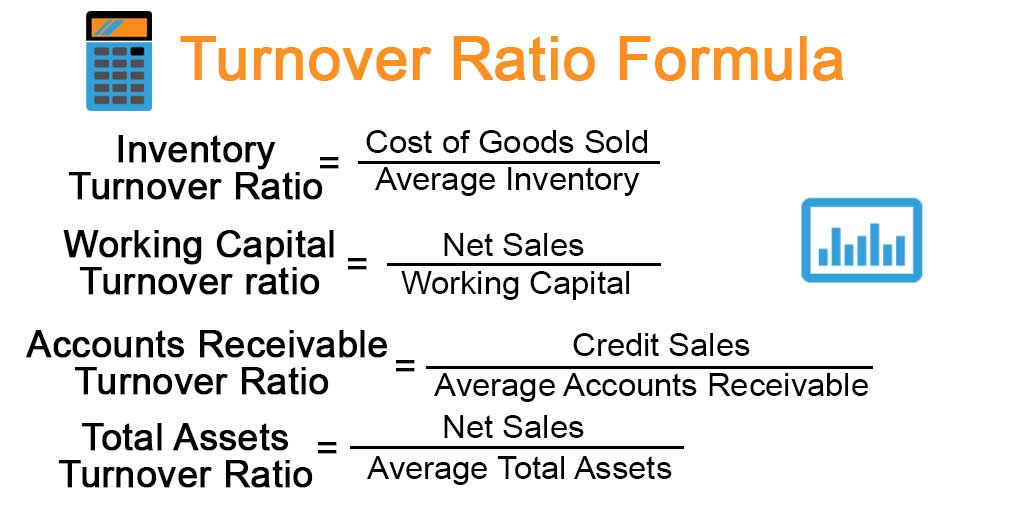

The formula to compute the receivables turnover ratio is net credit sales divided by average accounts receivable:

Receivables turnover ratio formula how to#

How to Calculate Accounts Receivable Turnover Ratio (+ Formula)Īccounts receivable turnover ratio measures the number of times in a given period (monthly, quarterly, or yearly) that a company always collects the average accounts receivable. You can be more efficient when billing your client and boosting your cash flow, this will improve your account receivable ratio. This will help you sustain a good cash flow and keep a perfect relationship with your customers. When offering accounts receivable, you have to make sure it matches your company’s credit strategy. It is also important for generating a perfect statement of income and balance sheet estimation. Or they deal with customers that pay at a later date than the date required to pay.Ī good accounts receivable turnover ratio is a very necessary part of small business bookkeeping. Low accounts receivable turnover ratios might be caused by the company’s bad credit strategies and a very imperfect way of collecting accounts receivable. It is not a bad thing, but it may drive potential clients away and they might move to other competing companies that can offer the credit they want.

When a company’s accounts receivable procedure is effective, and a large number of clients pay the money they owe the company quickly, this means the company may have a very high accounts receivable turnover ratio.Ī company’s accounts receivable turnover ratio can be high, which means the company might be prudent when giving credit. Another name for accounts receivable turnover ratio is debtors turnover ratio. The accounts receivable turnover ratio calculates how effectively a company collects accounts receivable (the money a customer owes the company). What is the Accounts Receivable Turnover Ratio? In this guide, you will learn everything you need to know about accounts receivable turnover ratio including how to calculate it, what it can tell you, how to improve it, what makes a good account receivable turnover ratio. This ratio measures how effective your business is at offering credit and collecting debts from your customers.īusinesses that handle their collections well (have a good account receivable turnover ratio) will enjoy more success at obtaining loans and attracting investors. One key metric that is valuable for businesses is the accounts receivable turnover ratio. There are several formulas and calculations involved in accounting that can make it complex to undertake for unskilled workers, however, they provide valuable insights into a company’s financial health and business operations.

Accounting is a key component of any business irrespective of its size.

0 kommentar(er)

0 kommentar(er)